Probably it will not be many, reading this article, who are not “in the know” about the short squeezing happening a year ago, when an online community on Reddit – subreddit r/wallstreetbets – surged by million of users in a short timeframe and coordinated a short squeeze attack on short-sellers “heavily engaged” into the securities GameStop and AMC.

In the aftermath the Citadel LLC multinational hedgefond and the investment fond Melvin Capital were incurred losses that raked up to around 6 billions of dollars.

This is not to be a history lesson in the art of shorting, but just a reminder, that what happened last year, was a fine example of the inherent “rottenness” at play in a financial system, even after the evident atrocities seemed rigged to minimize damages, as when brokering service Robinhood halted buying of these securities, in the wake of what was being incurred to Melvin Capital.

When talking about shorting, we eventually HAVE to talk about NAKED shorting.

If you’re into NWBO – otherwise what are you doing here … right? – you are probably going to ask yourself if naked shorting is “a deal”? Have you been around the NWBO board on Ihub, you will soon find out, that many belonging to the “opposition to the bullish case of NWBO” – bears, fudders, shorters whatever – tends to deny that to be the case, and often denies the “naked shorting concept” “as a whole”.

What IS naked shorting then?

Well, the possibilities in the inherent financial system for Market Makers to “legally” naked short any stocks by creating synthetic shares through options. To be able to short stocks without borrowing them. Sell deep in the money calls for a premium and buy deep in the money puts. Then sell you the “synthetic” shares, where there’s no borrow and and when the borrow gets pulled or bought in, Market Makers simply reverse that trade let’s say for June and roll it to July. And then when the issue happens in July they roll July into August etc. The trade rolls along, without ever having to deliver the shares. Loophole anybody?

After having watched movies like Margin Call or The Big Short, wouldn’t you think, those incidents somehow would lead to some kind of revelation at the SEC and Justice Department, who would want to start closing these loopholes and create a system, that protects not only companies from getting shorted to pieces but also to protect the little man and his hard earned investment money?

That “naked shorting” exists and that Market Makers takes advantage of it, is a fact.

Let me recommend this interview with ex-hedge fund CEO Marc Cohodes, in a discussion regarding how Market Makers practice driving down the stock price of companies.

I can also recommend a ten part series of articles on Naked Shorting, written by Larry Smith from the site Smith on Stocks. He has written extensively about NWBO during the years and covered a series of Adam Feuersteins - currently employed by STATNEWS -article attacks on NWBO.

In 2014 Larry Smith was first aware of short selling going on with regards to NWBO and described, how NWBO was short attacked and he coupled that with influence of Adam Feuerstein, at that time writing for TheStreet.com and his boss Jim Cramer at that time participated in an interview, where he described the shorting techniques to manipulate stock prices and said:

It’s a very quick way to make money, and very satisfying. And by the way, no one in the world would ever admit that, but I don’t care!

Controversies about Larry Smiths engagement and his brokerage past - due to being barred by FINRA in 2003 - came up in this extensive article in 2003, where an investigation uncovered, what can possibly only be called a “pumping scheme”.

Let’s me add, that “heat has definitely” been ongoing betweet Larry Smith and Adam Feuerstein during the years and while I can not in any way applaud paid pumping as well as paid bashing, read especially some of Larry Smiths articles about the attacks on NWBO and if you care for an older collage of articles being assembled on Ihub in 2014 regarding Feuerstein vs. Smith, this should give you an hour of entertainment.

With that said, In 2019 Larry Smith start to compile a ten part article series called “Illegal Naked Shorting’s Role in Stock Manipulation”, which I can highly recommend on the subject.

-

Part 2: “Conventional Wisdom on How Short Sales are Executed”

-

Part 3: “Prime Brokers and the DTCC Have a Troubling Monopoly on Clearing and Settling Stock Trades”

-

Part 5 “Traditional Shorting Compared to Naked Shorting (Both Legal and Illegal)”

-

Part 6: “The SEC’s Regulation SHO is Intended to Prevent Illegal Naked Shorting, But is Ineffective”

-

Part 8: “Who or What is Cede and What Role Does Cede Play in the Trading of Stocks?”

-

Part 9: “The Risk/ Reward of Shorting Versus Buying Stocks is Extremely Unfavorable”

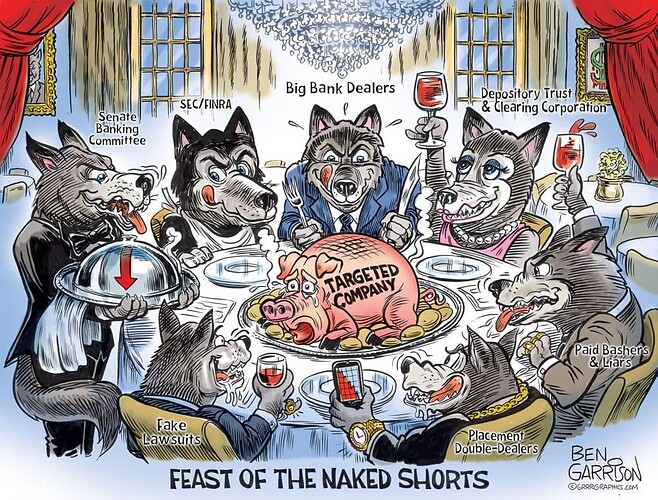

They tell a “fascinating” history of an inherent completely corrupt and fraudulent system, in which Market Makers essentially possess the power to “do a company in”. Not only from a trickle-down chain-of-command view, but down to engaging paid posters on messageboards like Ihub, Twitter, StockTwits and Yahoo, to kill positive sentiment with critical substanceless content, that can induce retailers with fear and doubt and get them to sell their shares at a discounted price.

If you start to get a sence of what I’m talking about, you might be participating on some of the said boards, discussing NWBO.

What all the above in mind, what can NWBO do to counter this reality, if anything at all?

In June 1999 Cofer Black was named director of the CIA’s Counterterrorist Center (CTC). In this capacity, Black served as the CIA Director’s Special Assistant for Counterterrorism as well as the National Intelligence Officer for Counterterrorism. in a “grand plan” for dealing with al-Qaeda. Black was the operational chief in charge of this effort.

In January 2016 Cofer Black became an independent director of publicly traded biotechnology company Northwest Biotherapeutics (NWBO) to investigate the market manipulation of the company’s stock by the hedge fund “wolfpack”. The wolfpack and others use naked shorting of stock to drive promising young biotechs toward bankruptcy or to the point where they need to raise capital at extremely low valuations from the wolfpack themselves.

To date, we have yet to see anything concrete by mr. Blacks engagement. That is five years of silence.

Let’s look at what went on, at the annual shareholders meeting early 2019.

Question 5: Can NWBO ovecome all of the forces that are aligned against them?

Answer (Les Goldman): “We’re still here. Lots of people didn’t think we would be.”

(Linda Powers) “I can only give a couple of comments from a personal perspective. Everyone in this company is committed in a deeply personal way to this company and this technology, for whatever their respective, personal reasons are. Nobody would go through this degree of abuse for this long a period of time for a business, and certainly not to collect a salary paycheck, as is regularly suggested on the message boards. I personally think that if we could get through what we’ve gone through the last three years, I kind of think we can get through anything. The year 2015, we had come out . . . we had just made very strong presentations, I believe many parties were surprised, at AACR, the largest research conference in the world, and ASCO, the largest clinical conference in the world. We were hit with multiple class-action lawsuits, we were hit with the anonymous Internet report, we were hit with an attempted hostile takeover. We were hit with just incredible things. When we look back on it now, it’s just amazing. In 2016 and 2017, were pretty horrific in their own way. And I’ve must say, this team, everything we do we do as a team. We do everything by unanimity. Management and the board, we have just kept doggedly putting one foot in front of the other. And we do say to ourselves not infrequently, ‘well, we’re not dead yet.’ And we take satisfaction in the fact that somewhere there’s a conference room with the bad guys in it who are saying to themselves, ‘what does it take to kill these people?’ Because what’s been thrown at us, stock manipulation, you name it, is staggering. But, this team will never give up. We might be crushed like a bug but we will never give up. And at this point, with the dataset . . . I hope everyone can appreciate the year 2018. The year 2018, at least in my perspective, was really transformative for us. We came out with two sets of interim data from the clinical trial. It’s not the final data, it’s not unblinded. The future may look different. That’s a classic forward-looking statement. But that interim data was . . . and I am only allowed to say really conservative things . . . that was encouraging. No one has ever seen that kind of survival in GBM with any agent or combination of agents. ‘That doesn’t mean the future will be the same as it has been.’ I mean, that was transformative. The financial deal we did in December was transformative. I’m told that one of the bad guy commentators now says the only thing we’ve ever been good at is real estate. At least we are good at something. With that dataset and the commitment of this team, all I can tell you is I believe that if anyone can get through this, I think we have as good a chance as anybody to get through what we are up against.”

(Les Goldman): “I only have one other thought, which I give a lot of thought to actually. In the context of your point about ’with the better our stuff gets the tougher and meaner the other guys get,’ there’s another word that goes with tougher and meaner and it’s more brazen. And the more brazen they get, maybe they’re walking into a trap. That’s as far as I’m going to go, because they have been . . . we have to be conservative in what we say . . . we’ll use the word ‘outlandish’ in how brazen they’ve been and the better our stuff gets, the more obvious they’re going to have to get and at some point, if you have built the right things that I was talking about before, with investor relations and media and you’re getting the story out there about the little engine who could, there will become a tipping point, I sincerely believe, that they’ll do themselves in. And we want to be there to catch it, and that’s all I’ll say about it but it isn’t just a one-way street where they rule the world, it gets tougher and tougher the better we get and that provides angles we can work with.”

Question 8: Where are the shares coming from that are use to short NWBO’s stock?

Answer (Linda Powers): “Those are great questions, I’m so glad you brought that up. I’ll tell you where they’re getting the stock from, they’re getting it from all of you guys. And that’s something we are painfully aware of and thinking about and that’s all I’ll say right now. Most people, most retail investors don’t know, that when you sign up for an account with a broker, they usually steer you into a margin account even though most people aren’t buying and selling stocks on margin. You’re not taking debt to magnify your investment. Buried in these 100-page contracts, you know when you go and click accept, we’ve printed them out, these 100-page contracts, and buried in the middle of them, the broker can lend out your shares, that you bought, and you own, they can lend them out and there’s only one use to can lend them out for, there aren’t multiple uses and we’re not sure which one they’re lending them out for, there’s only one use for lending shares and it’s to lend them to shorts. They lend them to shorts, they receive stock loan fees as revenue to the broker for lending out your shares, and they’re not required to tell you they are lending it out, they’re not required to tell you the money they receive, and the only usage of lending out your shares is to drive down the value of your shares. That is the state of affairs today with brokers. And it’s even worse when the brokers will put you on this OBO list where you’re not even, it’s not even visible that you’re the shareholder. The best thing is if the shares are in your name, not the street name, not the broker’s name and you don’t want to be on an OBO list and you don’t want to have a margin account, but a lot of the brokers make it difficult or impossible or adverse to have a different type of account. [] The best thing that you guys can do to help, is spread the word far and wide on the message boards, tell everybody, have your stock in your name, do everything possible to be in an account that is not a margin account, unfortunately from what we understand, the rules are being bent, quite far, so that even when it’s not supposed to be lendable it is being lent [] at least if your shares are electronic, this really matters. Because in our company estimates are that staggering amounts, in the triple-digit millions, can be involved in this and if we have about 14,400 shareholders, and if everybody would get their shares out of this situation where the brokers are lending itm out without your knowledge, and getting paid handsomely by the shorts for doing so, and keeping that revenue, and by the way, there’s lawsuits between the big boys over the amount of loan fees being paid, that’s how big the money flows are coming from this. And if you have your shares in an IRA, that’s the most juicy target for these brokers because you’re not trading. They just sit here. And the more they just sit there the easier it is for the brokers to use them and do this. So the best thing that you guys can do to help, which would be an enormous help, is spread the word and get all the fellow shareholders to get their shares out of this situation. And dry up the supply of shares for shorting Northwest’s stock.”

(Les Goldman): “Let me just add one thing, we’re always thinking about this. As part of my answer before, there will be programs and they will involve numerous activities. But we don’t roll them out one-at-a-time, it’ll be part of a total package.”

(Linda Powers): "We can’t talk about that."

Try to chew on that a couple of times:

But we don’t roll them out one-at-a-time, it’ll be part of a total package

Afterword

I don’t think nobody but shorters and fudders believe there is NO threats to NWBO. Market Makers down to posters on messageboards has their roles to play. The question is, whether NWBO – aside of having a successful trial and a scientific journal to prove it – has any means to counter them.

That is where Cofer Black enters the picture and where the countermeasures Les Goldman is talking about against shorting intertwines.

Cofer Black has been hired with a purpose and obviously his skills has been assessed and found important to get the job done.

In short eloquent writing, that is:

“… investigate the market manipulation of the company’s stock by the hedge fund "wolfpack”

I’m quite sure, we’re gonna have ourself a blast in the near future.