Valuation affected by anxiousness?

Definitions of anxiousness. a feeling of mild anxiety about possible developments. synonyms: disquiet. type of: anxiety. a vague unpleasant emotion that is experienced in anticipation of some (usually ill-defined) misfortune.

Anxiousness is what rules the NWBO “stakeholder community” currently, whether one is considered “long” or “short”.

While some insinuates NWBO is not updating its shareholders during the quiet period - somewhat of an oxymoron - we’ve had 3 press-releases during summer.

One.

Informing us about NWBO now being able to automate and scale production of DCVax-L to 12.000 a year.

In Denmark news medias have reported about breakthrough in T-cell therapies in different forms of cancers, all wondering how they are going to manage automation of personal vaccines in immunology. Not only have NWBO already solved that equation, their DCvax-L vaccine seems - according to the Linda Liau led SPORE 1 project at UCLA, the combo trial with DCVax-L and Mercks Keytruda - to drastically enhance efficacy against cancer, when combined with checkpoint inhibitors. The generic label of all these succesful T-cell agents, who all must yearn for the secret sauce of DCVax-L.

Two.

Filing of Application for License for Commercial Manufacturing.

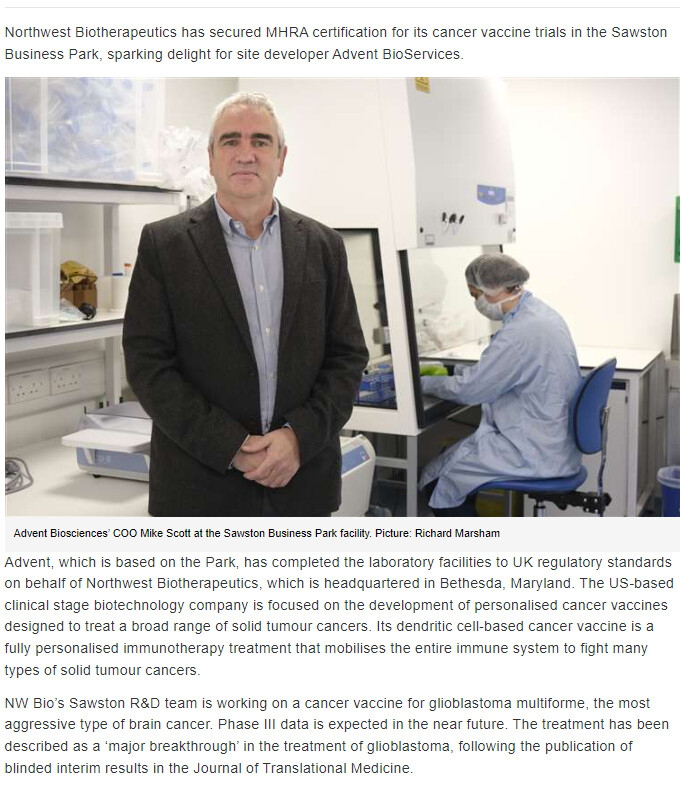

While the hordes of shorts have been bashing their heads to a pulp incessantly over Linda Powers personal ownership of Toucan and thus her controlling of the CDMO AdventBioservices - which resides in the same building as NWBO at Sawston - Advent Bioservices has ramped up their employee count from around 10, two years ago, to now 60. Specialists have been brought aboard and state of the art equipment installed to be able to sustain the demand that will follow after the approval of DCVax-L by MHRA in the UK.

Shorts are desperately trying to bury this signal and all sorts of tinfoil hat speculations are being spewed. That AdventBio is working for other customers. NWBO has sub-leased 1/6th. of the 88.000 square feets, so please do enlighten us, with the numbers.

Because british news media has already reported how AdventBio does NWBOs bidding (see bottom of this article) articles 6 months ago.

And Mike Scott CEO of Advent, was attending the British Neuro-Oncology Society Annual Meeting in Liverpool to hear Dr. Ashkan present results of the DCVax-L P3 trial, together with most of NWBO management (see image below)

NWBO is mother of Advent Bioservices, almost litteraly by having Linda Powers at the helm as the owner, who willingly accepts NWBO shares as a payment for NWBO’s services done by Advent.

Three

The MHRA Approval of the PIP Plan

This press-release is stating that the PIP plan (DCvax-L trials for children ) has been approved and the trials can be done post MAA application and marketing approval for the adults.

With this checked, we await final Sawston DCVax-L manufacturing approval and marketing approval itself, probably in rapid succession.

What is inherently messaged is even more important. That the approval as part of the PIP of external placebo controls reinforces, that the phase 3 use of external controls is and will not be an issue. Consistent with the UK accepting the SAP with OS endpoints and external controls.

How about that?

These are only the obvious press-releases from NWBO. You could add:

- Linda Liau has presented progress from the UCLA SPORE 1 combo trial with Keytruda three times during one year (see them all here)

- Advent Bio services ramped up employees to +60 from 10 in 2 years.

- Michael Fox and Sarah MacLeod have been added as IR/PR service providers.

- Linda Liau is going to present results in plenary at SNO November 20th.

Valuation of NWBO

If you feel the pessimism regarding the valuation of NWBO is growing, then read the little epilogue below. It is pure FUD tactics.

In reality I believe my former valuation of NWBO of around $30 a share, is now definitely the most pessimistic outlook.

- DCVax-L Platform for cancer treatment against ALL solid tumors.

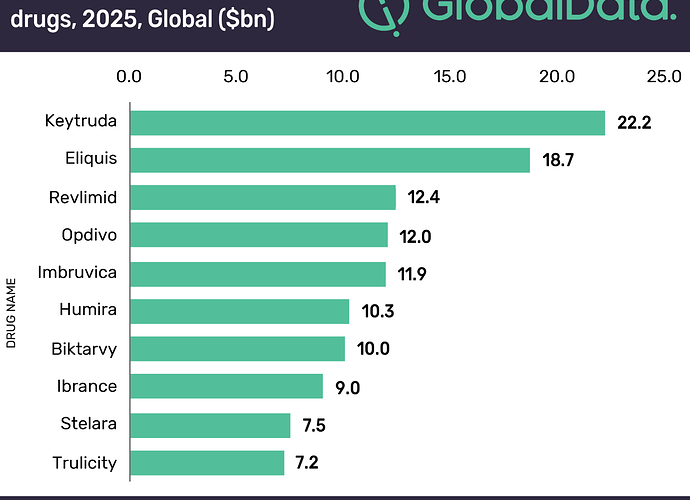

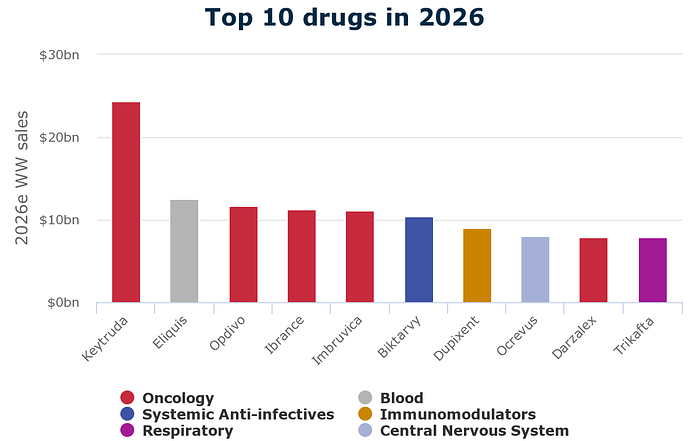

- Enhances efficacy drastically, when combined with PD1 Inhibitors, like Keytruda and Opdivo

- Upcoming DCVax-Direct phase 2 trial

- Upcoming combo trials with approved DCVax-L and approved PD1 inhibitors, will have expedited pathways

- It’s not just “What is DCVax-L worth on its own?”

- It’s “What can DCVax-L take from our business?”

Suck these messages in:

Why do you think Merck went out of their way to get rid of Bristol Meyers Squibb Opdivo as the checkpoint inhibitor in UCLAs SPORE 1 project combo trial with DCVax-L?

We explained that full story here - timelines and all and it STILL counts.

Linda Powers anxious to sell at $7?

Do you really think - after suffering harassment through articles, fraudulent law suits, being brought to OTC, buying Flaskworks, developing automation and scaling of personal vaccines, building up Advent Bioservices from 0 to +60 employees to do NWBO’s bidding, overcoming all sorts of obstacles with endpoints and trial design and waiting years more, to be absolutely sure they can supply demand, when approved … that Linda Powers are INCLINED … to SELL … NWBO at a share price …

between $7-12?

I am NOT disagreeing AT ALL, that at BO price of NWBO currently SEEMS to be reasonable valued around $7-12.

It is though, a pointless practice, because:

-

NWBO would NEVER sell at that price. That has not only been consistently signaled by management during years, it is also proved by the thoroughness with which NWBO has brought the P3 trial to a successful conclusion. BO remains a “maximum exit” practice.

-

There are too many “suitors” among big pharma companies, to be able to play the “waiting game”. There are several companies with successful checkpoint inhibitors today and each of them would gain IMMENSELY by acquiring the DCVax platform EXCLUSIVELY. It would not only enhance efficacy of DCVax-L + said checkpoint inhibitor drastically. More importantly. It would undermine the business of the competition.

-

Realizing the extreme revenue checkpoint inhibitors already have, you have to ask yourself, it any of these companies can afford to wait for right price, if they risk another company acquire NWBO?

-

And ask yourself, which of these companies, risk most by playing “the waiting game”? Nudge nudge … look at the global yearly revenue and look at the estimation for years to come.

-

With that in mind, look very closely once more at the "whole Duffy Connection" in 2019. Merck already came to the conclusion at that time, that they could and can not afford to let the DCVax platform fall into the hands of the competition. Keytruda is the bread and butter of Merck and what NWBO considers a maximum exit BO price, will be cheap considering the alternative.

-

With the above situation in mind … NWBO can NOT be priced according to “ordinary principles”. And the many years of having forces trying to stop or delaying the coming disruption has failed.

-

You can stop wondering, whether NWBO will have money enough to keep the engines running. Advent Bioservices is not a Linda Powers pet project decoupled from NWBO, as some would like to insinuate. It is the lifeline, build up for NWBO money with now +60 people and it feeds on the genius of the Flaskworks “invention”. LP has the funds even in a worst case scenario and the preferred C shares is designed for either a partnership or a down payment.

-

With all the above in mind and the DCvax platforms potential, the right thing to do, would be to partner with all that could add an ingredient to the sauce, that would enhance the efficacy of DCVax - or rather, the other way around. There are many with checkpoint inhibitors, but as of now, there is only one DCVax secret sauce and in the immunology department, competition are years down the road and currently without means to scale and automate.

-

It is game over. Wake up and smell the coffee.

Epilogue on FUD

Let’s get back to talk about anxiousness, because the meaning of fudders and shorters of constantly promoting FUD (fear, uncertainty and doubt) is to get YOU - as a retail shareholder - to sell your shares … CHEAP.

If you STILL don’t know how fudders and shorters operate, you should read this 101 manual, that should make a bell or two ring about the operations going on with NWBO.

You should ALSO read our article, How to Counter the Threats

You should realize that there ARE several people on stock boards and social medias, that ACT like they’re long, but aren’t. Some people are just pessimists and thats allright, but several are trying to play the fiddle of a long, but in reality whines like a short.

The best you can do is … MUTE … BLOCK. Kill their messages, by resisting the urge to comment.