The SEC is proposing new rules that will enforce short seller transparency.

Under the 13f-2 rule, short sellers will be required to submit a report on a monthly basis, specifying their short positions and short activity, which will provide regulators with insight on short seller trade.

This will significantly limit hedge funds ability to act in criminal ways, creating synthetic shares and working naked shorting schemes. They will have to play fair.

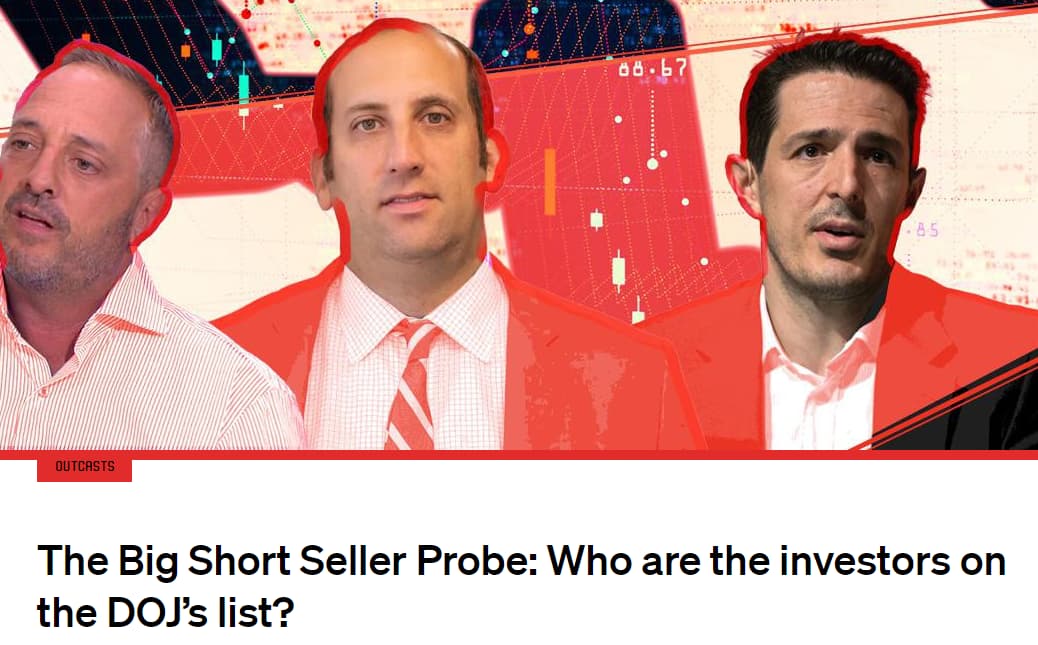

The report comes in the wake of the Department of Justice having slammed down hard on notorious short sellers in a probe since December and a series of articles, that have started to shed light on these criminal activities in a way that has forced the SEC to acknowledge that short selling has been used to manipulate the market to drive share prices down, confirming retail investors have been targets of “short and distort”.

This is very significant in light of the shorting schemes by Market Makers, we have observed daily with regards to NWBO.

As written in an article on FrankNez:

This statement alone is very significant for many reasons.

The SEC doesn’t need to be convinced of market manipulation anymore, they’ve acknowledged it.

They understand exactly what’s happening in the markets and how it’s affecting retail investors.

Now it’s just a matter of finding solutions to lift the suppression being imposed on heavily shorted stocks such as AMC and GameStop.

Disclosure of short sell positions and activity could very well be the start of it too.

Let’s look at a summary of the proposed rule.

Short Position and Short Activity Reporting by Institutional Investment Managers

The Securities and Exchange Commission (the “Commission”) is proposing a new rule and related form pursuant to the Securities Exchange Act of 1934 (the “Exchange Act”), including Section 13(f)(2), which was added by Section 929X of the Dodd-Frank Wall Street Reform and Consumer Protection Act (“DFA”).

The proposed rule and related form are designed to provide greater transparency through the publication of short sale related data to investors and other market participants. Under the rule, institutional investment managers that meet or exceed a specified reporting threshold would be required to report, on a monthly basis using the proposed form, specified short position data and short activity data for equity securities.

In addition, the Commission is proposing a new rule under the Exchange Act to prescribe a new “buy to cover” order marking requirement, and proposing to amend the national market system plan governing the consolidated audit trail (“CAT”) created pursuant to the Exchange Act to require the reporting of “buy to cover” order marking information and reliance on the bona fide market making exception in the Commission’s short sale rules. The Commission is publishing the text of the proposed amendments to the CAT NMS Plan in a separate notice.

There is a limited time to comment on the proposal, which could make the rule “come into play” sooner than later.

This new move COULD be connected to information that hedge Citadel seems to be “cutting ties” to infamous hedge fund Melvin Capital, who lost billions in the wake of the Gamestop short squeeze.

With that said, we are also awaiting news about the DOJ and their probe into infamous short sellers.

Perhaps things are starting to look brighter and maybe just in time for NWBO going public with TLD and a journal.